Month-end Reconciliations – A Masterclass in 6 easy steps

By Wendy Askins, CFE, MBA

Thorough month-end reconciliations are critical to uncover revenue anomalies, errors, and embezzlement. Relying solely on information that is offered to a business owner by a team member is dangerous. Embezzlers can manipulate reports, handwritten deposit slips, and other data sources to execute their schemes. However, they cannot manipulate third-party statements from outside entities.

All third-party revenue statements should be sent directly to a secured location accessible only by the business owner. Revenue statements include bank statements, merchant account (credit card) statements, third-party patient finance company (Care Credit and Lending Club) statements, Orthobanc or Vanco statements, and OrthoFi statements. Once the business owner has reviewed the statements, forward the documents to the bookkeeper or the individual responsible for practice financial data month-end reconciliations and retention.

The reconciliation process can be an arduous process that is best completed by an outside source instead of the business owner. Additionally, the reconciliation process should NOT be completed by a team member who has control over the posting of payments or control over the day-end processes. Many practice owners rely on an external bookkeeper or company that can complete the process virtually.

The reconciliation process begins by ensuring that all serial numbered computerized daysheets and deposit slips are represented and that there are no “hidden” records of adjustments or payments.

Using the third-party statements, confirm that the amounts of each payment method listed on the practice management software computerized deposit slip match the amount and timing of the deposit on the third-party statements. Physical payment methods (cash, checks, money orders) are located on the bank statement; funds electronically deposited to the bank are located on the individual company statement.

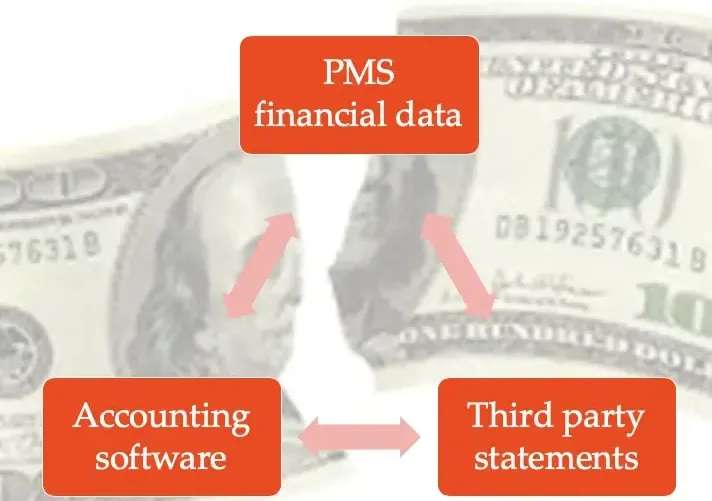

Once the revenue data from the practice management software is reconciled to all third-party statements, then move to a reconciliation of the business accounting software (QuickBooks, etc.).

Month-end reconciliations and your CPA

Many business owners assume that their Certified Public Accountant (CPA) is responsible for month-end reconciliations of their revenue. In actuality, CPAs are responsible for ensuring that expenses are categorized correctly and generating business financial statements. CPAs do not reconcile income from the practice management software with records of revenue on third-party statements. A webinar with tips for month-end reconciliations tips can be found on the Prosperident website and YouTube channel.

If you suspect embezzlement is occurring in your practice, please seek advice from individuals who specialize in financial crimes committed against orthodontic specialists.

Prosperident is here to help! Click the button below.